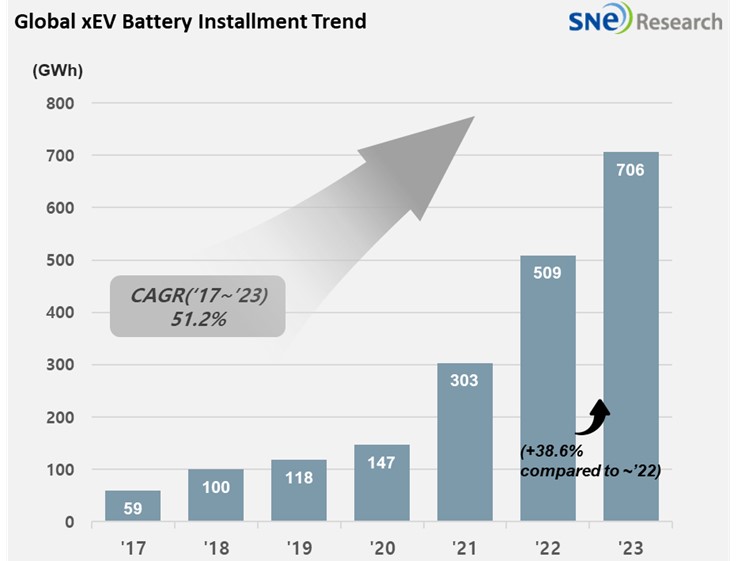

From Jan to Dec in 2023, Global[1] EV Battery Usage[2] Posted 705.5GWh, a 38.6% YoY Growth

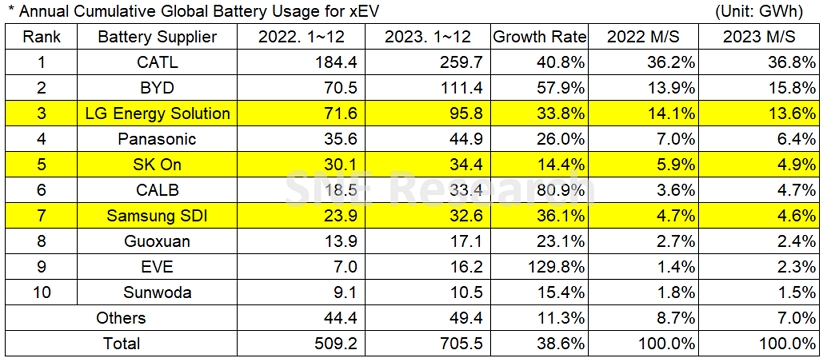

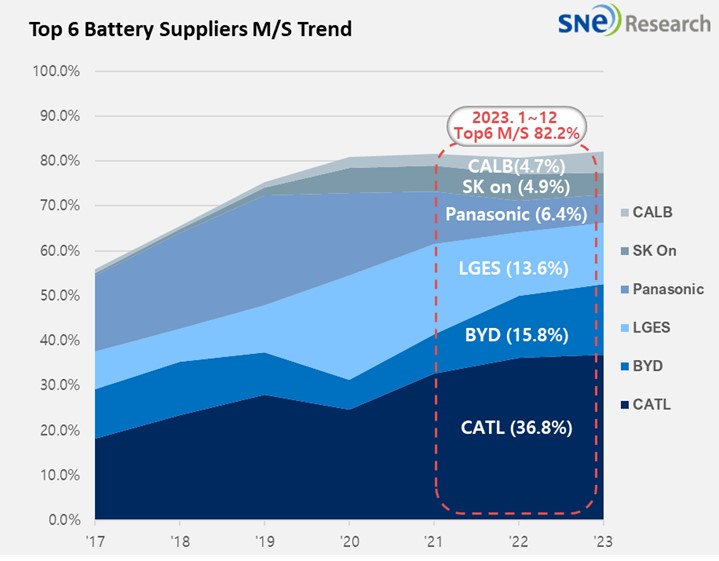

- From Jan to Dec in 2023, K-trio’s M/S recorded 23.1%

From January to December 2023, the amount of energy held

by batteries for electric vehicles (EV, PHEV, HEV) registered worldwide was

approximately 705.5GWh, a 38.6% YoY growth.

(Source: 2024 Jan. Global Monthly EV and Battery Monthly Tracker, SNE Research)

The combined market shares of K-trio companies were 23.1%, declined by 1.6%p compared to the same period of last year, but the overall usage of K-trio battery stayed in the upward trend. LG Energy Solution ranked 3rd with 33.8% (95.8GWh) YoY growth. While SK On ranked 5th with 14.4% (34.4GWh) growth, Samsung SDI took the 7th place with 36.1% (32.6GWh) growth.

(Source: 2024 Jan. Global Monthly EV and Battery Monthly Tracker, SNE Research)

The growth trend of K-trio was mainly affected by favorable sales of electric vehicle models equipped with batteries of each company as well as the increasing number of newly launched vehicles. Samsung SDI, recording the highest growth among K-trio, continued its growth thanks to the solid sales of BMW iX/i4/i7, Audi Q8 e-Tron, and FIAT 500e in Europe as well as decent sales of Rivian R1T/R1S and BMW iX in North America. Samsung SDI, targeting the premium EV battery market, has continuously expanded the sale of high-value-added battery P5 and enjoyed stable demand from the market and high profitability. All of these allowed Samsung SDI to break the record-high sales amidst growing concerns about possible slowdown in the EV market growth. Samsung SDI announced that it has been planning to enhance its sales and profitability by increasing the sales of high-value-added products such as P5 and P6. It also has a plan to get new platforms and operate new production bases in the US.

SK On recorded a growth thanks to global popularity of Hyundai IONIQ 5 and KIA EV6, global sales expansion of KIA EV9, and solid sales of Ford F-150 Lightning in North America. Recently, as it has been reported that SK On successfully reached to a decent level of accomplishment in developing prismatic and LFP battery, which is highly sought after in the market, it is expected to expand its market share mainly in the North American region.

LG Energy Solution also posted growth led by favorable sales of Tesla Model 3/Y, VW ID. Series, and Ford Mustang Mach-E that are highly popular in Europe and North America. Although OEMs such as Tesla, Ford, and GM have been expanding their installation ratio of LFP battery and uncertainties are still high in the market due to concerns about sluggish demand, LGES is determined to have a competitive edge through accelerating the development of high-voltage, Mid-Ni NCM and LFP battery as well as mass production of 46xx series. In addition, as it is expected to see launches of new vehicle models to which the Ultium platform is applied, such as GM Blazer EV, some of uncertainties are expected to be cleared off with the increasing usage of Ultium Cells battery.

Panasonic, the only Japanese company in the top 10 on the list, recorded 44.9GWh, a 26.0% YoY growth. Panasonic, one of the major battery suppliers to Tesla, has most of its battery usage installed in Tesla Model Y in the North American market. As it is reported that Panasonic is about to introduce its advanced 2170 cell and 4680 cell soon, Panasonic is expected to see an increase in its market share mostly focusing on Tesla in future.

CATL posted a 40.8% (259.7GWh) YoY growth, keeping the global top position. In China – the world’s biggest EV market – CATL has supplied battery to most of bestselling models such as ZEEKR 001 and GAC AION Y as well as major global OEMs such as Model 3/Y, BMW iX, and Mercedes EQS, becoming the only battery maker who takes up more than 30% of market share.

BYD took the 2nd place in the global market with a 57.9% (111.4GWh) growth based on its high popularity earned in the China domestic market. BYD is known for its price competitiveness through vertical SCM integration such as in-house battery supply and vehicle manufacturing. Recently, it has been rapidly expanding its market share in other regions than China mainly with its Atto 3(Yuan plus) model and Dolphine.

(Source: 2024 Jan. Global Monthly EV and Battery Monthly Tracker, SNE Research)

In 2023, the EV market saw a slowdown in growth due to several reasons: early adopters sated with electric vehicles; continuation of high interest rates and high price; and economic slump. All of these circumstances have led the EV market to reach the chasm phase. With the sluggish growth of EV market, major EV makers have made a downward modification of their EV production volume. As the price of key battery minerals has decreased, there also has been a reduction in battery selling price and profitability. Although concerns have been escalating across the battery industry with a growing possibility of industry downturn, it is still expected that the EV market would keep its growth momentum in the mid to long term. Thanks to major countries’ keeping the concept of carbon neutrality and strengthening their regulations on carbon footprint, the EV market is expected to overcome short-term growing pains. Particularly in the North American market where the EV penetration rate is relatively low, a significant amount of investment seems to be made to maintain long-term competitiveness and improve profitability in the long run.

[2] Based on battery installation for xEV registered during the relevant period.